Oil Shows Up-Momentum as Dollar Sinks

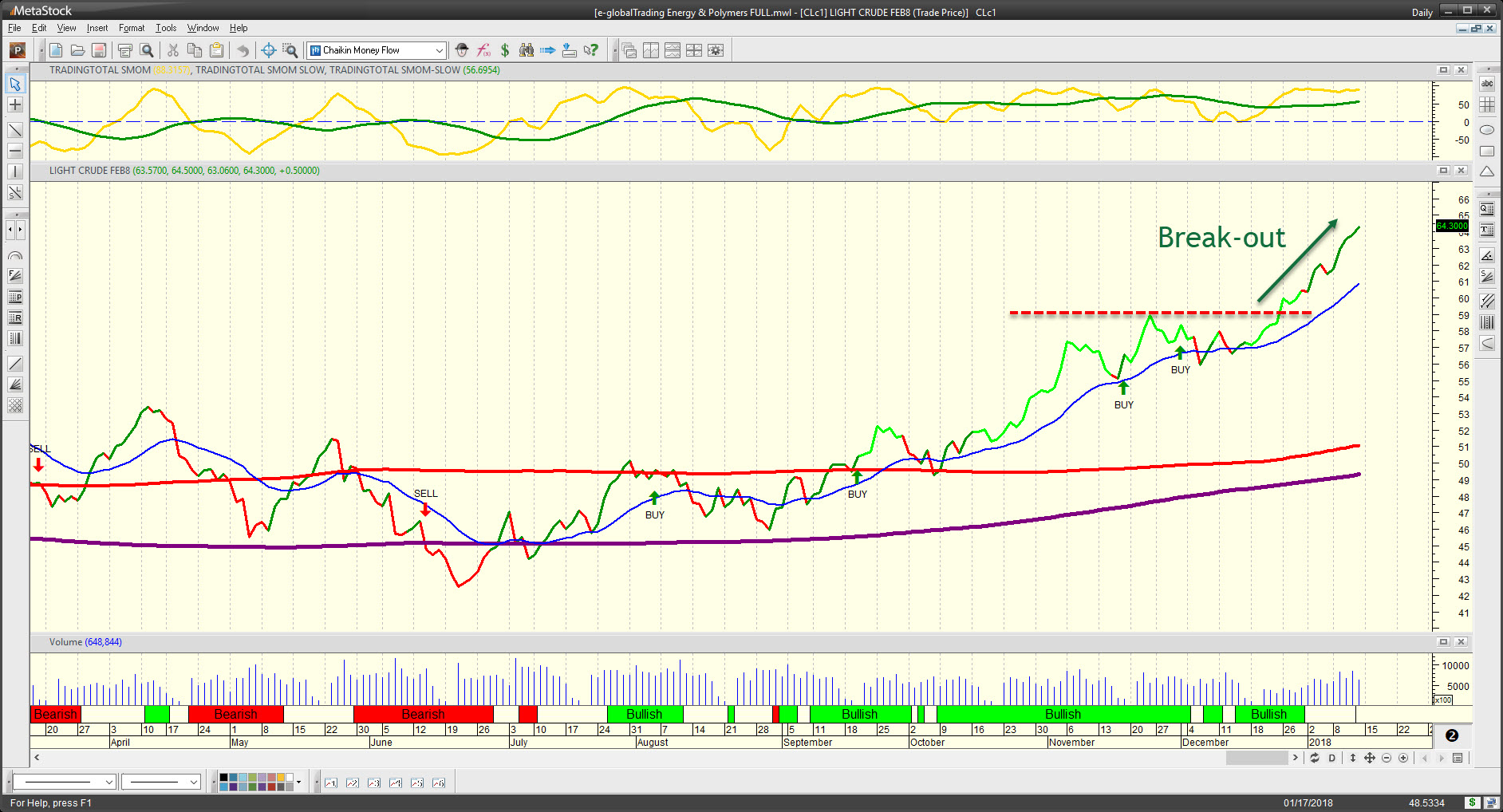

As expected, Crude Oil accelerated its up-move breaking the 64 US$/barrel price level as US$ Dollar just broke down an important technical support.

The future CLc1 futures contract is now looking for the next 66 US$ resistance area. That resistance area, which was formed more than 3 years ago in the middle of the crude oil price crash, doesn’t seem to be too strong for the current high momentum up-move.

At the same time, and as we warned you last week, the US$ Dollar finally increased its bearishness breaking down the daily support (not shown), which definitely added more fuel to the crude oil bullish cause.

Next Technical events to be observed

The next key technical event to be possibly observed is the Dollar Index DXc1 retest, which should keep the index below the recently broken support if we want to count with Dollar as additional factor to keep the current crude oil bullishness. Specifically regarding the crude oil CLc1 future contract, the possible coming key event should be the next retest or “how deep its next pullback will be”. As a bull fan, you shouldn’t like to see a crude oil retracement larger than 30-35%, in order to keep your bullishness well alive.

Chart and Data provided by MetaStock and EIKON powered by Thomson Reuters. Alerts provided by e-globalTrading