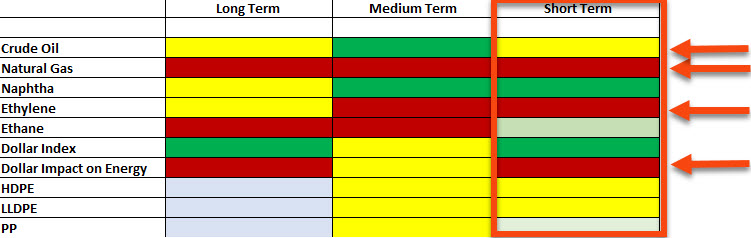

Energy Drivers Starting to Show Technical Alignment into Down Direction as Polymers Prices Look Steady

Energy Derivatives Trend Matrix provided by e-globalTrading

Energy market is starting to look some kind of incipient agreement into the down direction. As shown at the corresponding charts, there is only one energy driver showing strength, the UNc1 Naphtha (green color at the table), which is still behaving bullish, but into the long term EMAs area, (violet 450 EMA and red 200 EMA).

Naphtha UNc1 future chart provided by MetaStock, Alerts provided by e-globalTrading

At the same time, Crude Oil Clc1 future contract is now looking for the EMAs cluster formation, as a support to be confirmed, which is still technically bullish, but showing some lack of follow through. Note that the 3 Crude Oil SMART BLUE BUY alerts, shown at the beginning of April, are now looking a little far away from today’s price action. In short, Crude Oil is still slightly bullish, but losing momentum into support and also looking for a bullish re-test confirmation, which will probably be re-solved during the next 5-10 days from now.

Crude Oil CLc1 future chart provided by MetaStock, Alerts provided by e-globalTrading

Natural Gas NGc1 future contract is also looking extremely weak, with room enough to go lower than the current 2.56 US$ cts. level.

Natural Gas NGc1 future chart provided by MetaStock, alerts provided by e-globalTrading

At the deeper down-stream level, key raw materials, Ethylene and Ethane, are both showing clear long and medium-term weakness, as shown on the corresponding charts, which is also highlighted at the Energy Derivatives Trend Matrix. Another sequence of SMART SELL Alerts at Ethylene MBc1 future instrument, would definitely be strong enough to increase the odds of having a price break-down channel continuation, with the obvious possible bearish implications for polymers.

Ethylene MBEc1 future chart provided by MetaStock, Alerts provided by e-globalTrading

Finally, Dollar Index DXc1 future is still bullishly sideways, with the obvious potential bearish implications for energy derivatives. However, we didn’t trigger a good quality BUY Alerts since last year, which is technically reducing the referred Dollar relative bullishness, which means Dollar is not that strong as a bearish factor for energy instruments.

Dollar Index DXc1 future chart provided by MetaStock, Alerts provided by e-globalTrading

Summarizing

4 out of 6 drivers are showing clear weakness (Natural Gas, Ethylene, Ethane, Dollar Impact). One driver is short term steady (Crude Oil) and just one is still bullish (Naphtha). Is this good enough to make an e-globalTrading RED FLAG call-out into the down direction for polymers? No, definitely it’s not strong enough to call-out our RED SELL Alert, but it seems to be clear enough for having some doubts about a polymer price increase, at least for a sustainable solid price increase movement.

Non-integrated liquid feedstock-based petrochemical companies are probably having some troubles with Naphtha price increase. So, the current attempt to increase polymer prices looks more like a margin re-composition necessity than a real whole energy drivers impact consequence. Ethane-based petrochemical companies are obviously having a much better margin situation.